Disclosure: I am long

BKE.

(More...)

The Buckle (

BKE), an apparel retailer for young women and men, has attracted a large short position: 33% of the float is

held short. This is one hated stock: 5.8 to 9.4 million shares out of a 27.5 million count float have been shorted for the

last year and has been one of the most consistently shorted stocks of the last three years. Looking over my old articles, I discovered one from 2010 discussing the

enormous short interest in Buckle. And yet, despite such a dedicated short interest, Buckle has almost tripled in value over the last four years, confounding those who bet against it.

Normally, I would be concerned by the continuing large short position. Short sellers have a reputation for correctly picking losing stocks. However, in my opinion, Buckle will prove them wrong once again. This stock has 40% upside when you factor in share appreciation, dividends, and a potential special dividend. Some of that fuel will be provided by short sellers covering - and probable analyst upgrades (as I will discuss shortly.)

Why So Many Are Short The Stock

Who can blame those wagering against Buckle? They are reading bearish analyst reports. Just look at the analysts' input: All of the nine analysts who follow Buckle are

negative - so negative, that they have slapped a mean price target of $42, roughly $7 below the current trading price, and each of them believes Buckle is overpriced (target range $36 to $47). Just like the shorts, the analysts have been consistently negative on Buckle. Of the nine analysts, not one has upgraded the stock in years. Currently, there are 6 holds, 2 underperforms and 1 sell. And just like the shorts, all of the analysts that follow The Buckle have been consistently wrong.

The crux of their bearish argument: Buckle cannot maintain its remarkably high operating margin. In 2011, Goldman

downgraded the stock because "margins and productivity are at peak levels." J.P. Morgan

concurs given the company's "peakish margin levels." Last July, KeyBanc called Buckle's margins "

unsustainable."

(Oddly, the analysts have

liked Buckle competitor, Aeropostale (

ARO). Imperial Capital and RBC have had an outperform recommendation for almost a year even as shares have continued to fall 33%. Only 2 firms - Janney Montgomery Scott and Caris & Company - downgraded Aeropostale over the last year; however, those downgrades occurred after shares had already cratered. In contrast, I have been counseling going long Buckle and short Aeropostale for

2 years - a position that would have paid off handsomely.)

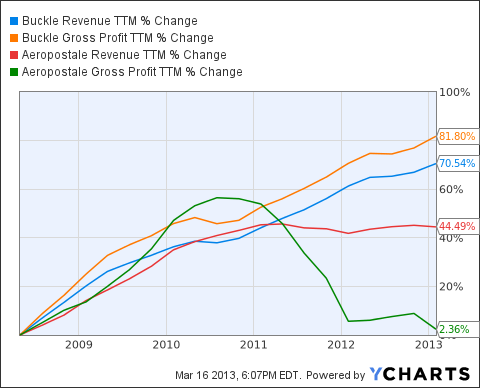

The Margins

Buckle's operating margins have been extraordinary, rising hundreds of basis points above their competitors. Margins are

2000 basis pointshigher than Aeropostale. The chart below follows O.M. on a TTM basis. Margins for the recently reported

quarter reached 27%, a 100 basis point improvement over last year, much to Merrill Lynch's surprise (expressed

during the call).

Why Excellent Margins Are Here To Stay

I could have told you Merrill margins would climb in the just reported quarter. Why? There have been little to no markdowns in the stores. Wander over to the competitors and you will see "Two For One" and "Price Reduction" signs all over. Indeed, the quarter - like most of the recent quarters - have been clean. Leaving the quarter, Buckle looks

well-positioned inventory-wise (matching my perception of the individual stores):

As of the end of the quarter, inventory on a comparable store basis was down approximately 1.5%, and total markdown inventory was down compared to the same time a year ago. The reduction in markdown inventory was the result of a decrease in the 20% off category.

Contrast that shopping experience

to Aeropostale's:

As Tom mentioned earlier, similar to many other retailers, we've been experiencing challenging macroeconomic headwinds and its impact on customer traffic into the first quarter. Additionally, based on the sales shortfall in the fourth quarter versus plan, we are planning increased promotional activity compared to the first quarter last year to clear through inventories.

In addition, The Buckle has been ramping up its private label offerings, a high margin business. This year, private label represented a third of sales. Three years ago, private label

accounted for a quarter of sales.

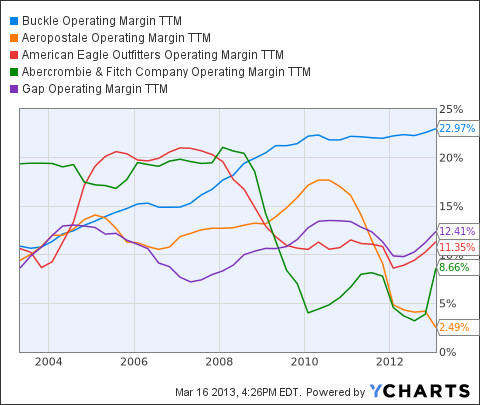

The Buckle has superbly managed gross margin year after year. Again, compared to Aeropostale, Buckle shines. Buckle has been able to get customers to pay more. Average women's price point rose from $37.75 (

2009) to $49.05 (

2012).

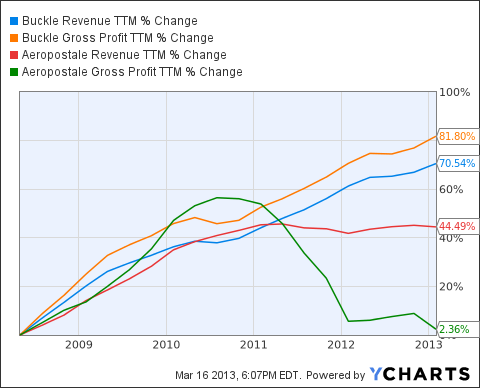

Compare how much better Buckle has done in delivering gross profits than Aeropostale.

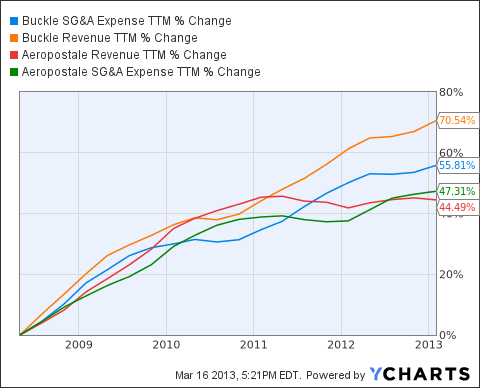

Moreover, Buckle manages overhead better than its peers. Revenue has climbed much faster than SGA. Compare how well Buckle has handled overhead versus Aeropostale.

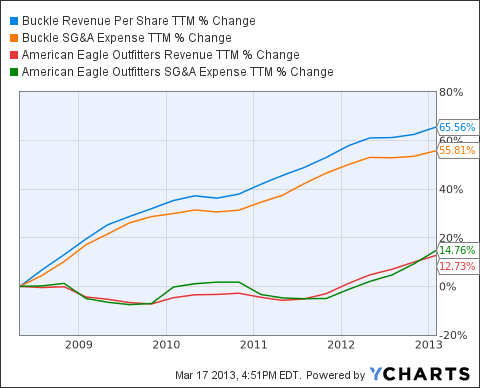

Buckle's SGA management clobbers rival American Eagle (

AEO) as well.

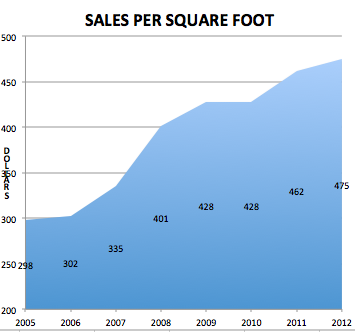

SALES PER SQUARE FOOT IS CLIMBING

Buckle has more than margin going for it: Sales per square foot has been climbing. This has been driven by improving merchandising, higher price points, and store remodels.

(My data sourced from 10Ks.)

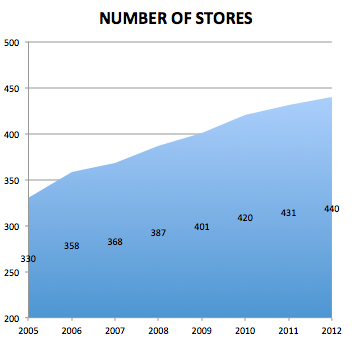

Further, store count has increased. The Buckle has been carefully adding stores, going for slow steady growth.

(My data sourced from 10Ks.)

Undervalued And Then Some

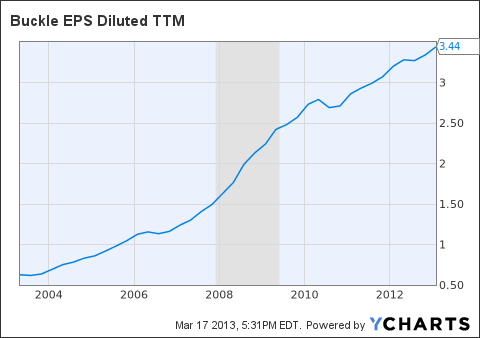

With 33% of the float held short, you'd expect Buckle to have a nosebleed valuation, wouldn't you? Yet, the stock has a trailing P/E of 14.6 and a forward P/E of 13.4. Contrast that to

industry average trailing P/E of 19.4. Yet, Buckle has delivered consistently better EPS TTM including 2008 and 2009.

Buckle Is Showing You The Money

Buckle is famous for its special dividends. The company has handed out $1.80 to $4.50 in one-time dividends in each of the last five years, a total of $13.05 a share, probably making it the most consistent special dividend payer of all U.S. companies. Including its regular dividend, The Buckle has paid out an average $3.80 a year, about 10% a year.

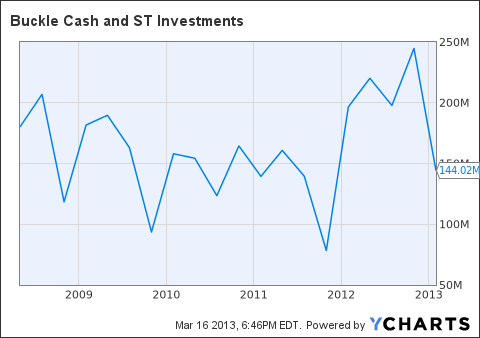

The company has $144 million in cash and short-term investments (even after paying out $255 million in 2012 dividends) - leaving the balance sheet in far better shape than at any other time after paying a special dividend. For example, cash on hand in the quarter following special dividends has been $118 million (2008), $93 million (2009), $139 (2010), and $78 million (2011). The Buckle's $144 million in cash sets it up for another one-time dividend. It is my belief Buckle will hand out another large special dividend this year.

The Buckle expects $34 to $38 million in capex, not too far off its usual $32 to $36 million, indicating that the company will not have large capital requirements. Buckle should easily be able to rebuild its cash and enable it to announce a $3.00 to $3.50 special dividend later this year.

As For The Shorts

My conclusion from observing those betting against Buckle: The shorts figure they could waltz out of their positions before a special dividend is announced. Perhaps, but I'm going to speculate that the company does something that will wreck their plans: Raise the regular dividend and/or announce a buyback. After all, $38 million in yearly regular dividends is way too low for a company throwing off a $180 million in free cash. Possibly that thought will help convert the shorts to longs. Doubling the quarterly dividend would create a short minefield as would a dedicated share repurchase program.

By the way, The Buckle is trading at $48.88 (as of March 15) - not far from the price when it announced its 2006 and 2008 3:2 split ($47 and $55 prices respectively). While splitting isn't supposed to add value to shares, it does get the juices flowing. If Buckle maintains this price or goes higher, expect a split later this year - something more for short sellers to think about.

The Buckle has climbed despite negative analyst write-ups. It's doubtful analysts can maintain their bearish stances in the face of being wrong so often about the stock. This year, the share price may be driven higher by overdue analyst upgrades.

Additional disclosure: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Excellent article. Simple and right to the point. A perfect Buffett analysis. The high short position, as you mentioned, is baffling. So much money has been lost by the shorts that maybe it's now just desperate emotion taking over(a double or nothing scenario). Analysts don't like to look so foolish for so long. Margins too high? Margins are simply the result of a well executed business model. It's been done before by all successful businesses. BKE is setting up to have the strongest year yet. Sooner or later the shorts will realize it's time to accept defeat and move on. There's only so many kicks to the head one can absorb.

To figure out why stock analysts are so frequently and predictably wrong, you have to turn to behavioral economists. Their work in recent decades shows that people forced to make complex, uncertain decisions often fall back on informal rules and personal biases. Comedy and tragedy ensue, and in roughly equal measure.

On Wall Street, that typically results in expecting short-term trends to continue longer than they actually do. It also leads folks to underestimate the chances of an earthquake flattening the markets. Such inclinations aren't limited to equity analysts, of course. The entire financial crisis, along with previous speculative spasms, owes in some way to these alternating currents of exuberance and despair.

Another well-known, somewhat malodorous factor affects stock analyst forecasts -- the herd. In a highly influential 1990 study, economists David Scharfstein and Jeremy Stein showed that investment managers often follow their peers in calling the market, even if they know the pack is stampeding off a cliff. Why? Paradoxically, it's safer.

As Stein told writer John Cassidy in the latter's excellent book:

"The underlying idea is that if you do something dumb, but everybody else is doing the same dumb thing at the same time, people won't think of you as stupid, and it won't be harmful to your reputation."

Cassidy also cites other research finding that young fund managers whose forecasts bucked industry consensus were more likely to get fired -- regardless of how those funds performed. Put another way, it's frequently better to be wrong in numbers than right all by your lonesome.

Hey, we're human, no matter what the color of our pin-stripes. Like the rest of us, stock analysts seek order in chaos. Good luck with that. As everyone knows, that can drive otherwise sane primates totally ape crazy.

can you please explain further? what is TA(total assets)??

Yes. TA=total assets. Also known as Q ratio or Tobin's Q. It's only one of so many ratios folks look at. I find it a quick guide as to whether I may have further interest in a name.

Q=capitalization/total assets

Last I looked BKE was >4

ARO was~1.6

KSS ~1.3

Anything around 1 or less considered OK by followers of this ratio

Just one of my tools and not necessarily a reason to act and I have no idea as to whether those shorting are using this ratio or not.

i have to blunt when I say there is so many things wrong with that ratio. How do you account that BKE has paid out around 800m in dividends, how do youaccount for a company that has inflated TA because they took on massive debt, how do you account for a company that's TA is artificially inflated with garbage intangibles like Goodwill? BKE is a Buffett stock. Not flashy or exciting but a cash cow moneymaker that will slowly make you very wealthy

As I said- it's one tool, not a formula to buy or sell. Use it as you will.

As for me- and as you point out- I deduct goodwill and intangibles if they are a significant amount. BTW- I always pass on stocks with a high % of goodwill compared to TA.

Thanks for your thoughts.

Oh!- I have always liked BKE; never bot it, sorry to say.

BKE seems around fairly valued right now. Wouldn't mind adding during a pullback.

Thanks for the article and I found it very useful.

I am long BKE and have been puzzled by the high short interest. So your article shed some light and make me start to know the other side of the coin.

Some questions here:

1, In your view, would the age of management be an issue here? BKE, seems not different from Apple and Disney, was ran by one leader, Denis Nelson, for a long time. Nelson is 62, entering retirement age. So it seems to me one concern of the company is its successor in leadership.

2, Another concern of mine is Buckle's expansion plan. They have been expanding in a very conservative way and chose the best locations possible when starting new stores.

Now, the issue could be ...... such premium locations are quite limited. This could limit the expansion speed of the company.

In any case, looking forward to hear your thought,

33_Alpha

As for #2: Buckle moves carefully when it expands. Most states don't have Buckle yet. I don't think Buckle has run out of locations. They usually go into busy malls and there are plenty of those.

Thanks for your reply.

Arthur

To your first concern BKE is not run by one person but many officers who have followed the same path as Nelson(internal growth) This company is run by "many Nelsons"

For your second concern. Run out of expansion opportunities? Think about that for a second. BKE has barely touched the most populated and wealthiest part of the country, the Northeast. Let alone most the rest of the country and eventually ahem.. the world. You will double your investment in 5-7 years.