Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

After doubling in two years,

PetSmart (PETM) has been range bound between $64-$72. This pet specialty retailer looks ready to roll over and play dead.

The company is trading at valuations that are greater than its 5-year historical PE, P/B, P/S, and P/CF averages. At a pricey 21 P/E, it's poised for a correction.

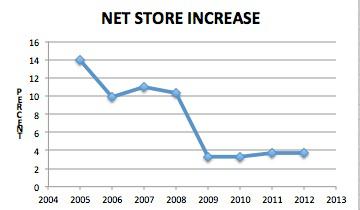

PetSmart's high-growth days are behind it. The company is no longer putting up lots of new stores as its market is becoming saturated. Last year, PetSmart added 46 stores to a 1232 base, a 3.7% increase. Gone are the heady days when the company grew its store count by 14% (2005).

Instead, PetSmart is relying on boosting its margins to deliver earnings growth. That's been successful so far. However, it's hard to improve on a 9.2% operating margin. Very few brick-and-mortar retailers top that.

PetSmart's margins are unlikely to keep climbing. In fact, they might start to decline for the following reasons.

- The payroll tax has reverted back to 6.2% leaving less money in the pocket. That should help drive more customers back to the less expensive grocery store, Wal-Mart (WMT), Target (TGT), feed stores, Sam's and Costco (COST), and on-line shopping.

There's nothing unique about PetSmart. Walk into any Petco, a private chain selling pet products. Petco looks identical to PetSmart - same merchandise, dog grooming and training. Petco has a similar store count and its stores are in the same zip codes as PetSmart.

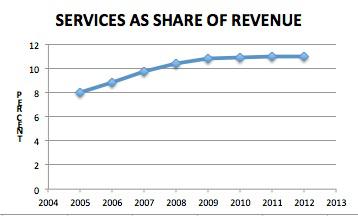

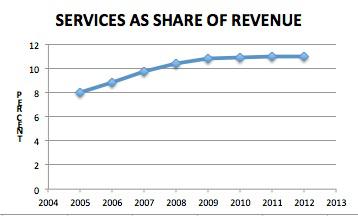

PetSmart's higher margin service business doesn't have as much room to run. The chart below shows the gradual deceleration in service growth. Services as a share of revenue have topped out.

4. PetSmart is over-staffed.

PetSmart has over 23,000 full-time and 27,000 part-time employees. The company has 1278 stores. That's an average of 18 full-time employees supporting an average store. In contrast, Tractor Supply (TSCO) is similarly sized with 1151 stores but has a far fewer 8700 employees for a much lower eight workers per store count.

While pet owners love their pets, there are other options. I'm reminded of another retailer, Toys "R" Us (

TOYS). Investors believed that customers would never abandon the toy retailer. Eventually, that's what shoppers did, spending their money at

Wal-Mart and Target instead, and cratering Toys "R" Us.

PetSmart may be the next Toys "R" Us. I would look to a significant pull back in PetSmart.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Weren't those options around in 2010 when the margins increased as well? It's not as though Petco, Walmart and Target opened up this year or even last year. Petsmart has PetsHotels - I don't think Petco has similar? WMT? TGT?

What customer does PETM target? The higher-end or the lower-end? The economy has been slow for a while now, yet PETM continues to do well? If the economy picks up, won't that help PETM? Sure, payroll tax is up, but I think employment picking up will do more to offset that if it happens.

If this is true, I think it would take more than the payroll tax going back up to put a dent.

"The American Pet Products Association, or “APPA,” estimated that the market for pet products rose nearly 200% from 1994 to 2011, and will reach $53 billion in 2012, reflecting 5.3% growth year over year. It attributes part of the increase to baby boomers with empty nest syndrome (loneliness caused by offspring leaving home), as well as young professionals putting off having children in favor of focusing on their careers."

Not saying PETM can't/won't go through a correction - that's possible in any stock, but I don't think it necessarily means that the company is about to collapse like Toys 'R Us did.

BTW - Maybe you aren't aware, but most stocks are trading above their 5 year multiples. That's what happens to a stock market when a country climbs out of a deep recession.

I think the mentioning that "PetSmart is over-staffed. PetSmart has over 23,000 full-time and 27,000 part-time employees. The company has 1278 stores. That's an average of 18 full-time employees" I believe this to be a tad-bit over generalized. From a consumer point-of-view I have never seen 18 employees in a PetSmart and one has to remember a lot of PetSmarts have a veterinarian on site/ possibly a vets assistant/ sales staff that is more knowledgeable that a Wal-mart pet section employee/etc etc.

I would only be concerned about PetSmarts competition if they decided to expand there Pet sections to include more services and offerings as PetSmart is doing. Right now, I don't see that happening as PetSmart still has a strong hold on the Pet market. However, On the flip side you are correct about the trading range/fundamentals, which it has been suck in for a while; I just don't think this is a great short sale candidate

PETM seemed bubbly in valuation and this is just proving it