Disclosure: I am long

OZRK. The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

(More...)

Bank of the Ozarks (

OZRK), a regional bank based in Arkansas, seizes opportunity like

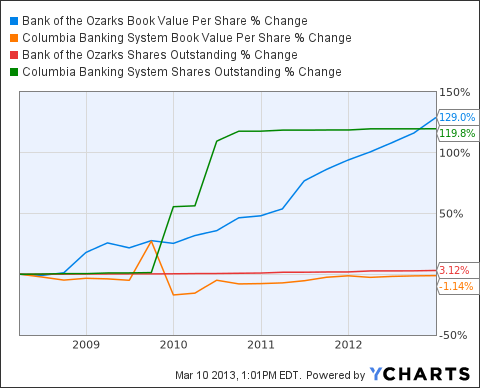

few other financial institutions. While most banks were left reeling during the Great Recession, the company opportunistically acquired seven failed banks through FDIC-assisted transactions, expanding its footprint into Florida, Alabama, Georgia, and North and South Carolina. These acquisitions were extraordinarily successful. All were done at bargain basement prices so that the deals were profitable from day 1 and financed themselves: Not one share of equity was needed in doing the transactions. Indeed, Bank of the Ozarks has maintained nearly the same 35 million share count as it did in 2003.

The Background

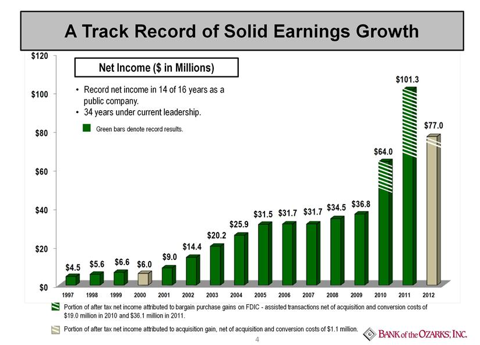

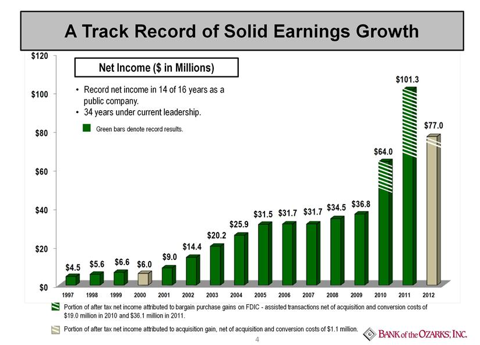

CEO George Gleason took over the then 2-branch bank ($28 million of assets) and transformed it into a 117 branch powerhouse ($4 billion of assets) with a $1.47 billion market cap. Through its metamorphosis, the bank has reported record earnings in 14 out of 16 of its years as a public company - remarkably, that includes even our economically difficult 2008, 2009, and 2010. 2012 would have been another record year except that the bank made $100 million in 2011 on a one-time acquisition gain.

(Click to enlarge)

(Click to enlarge)

Since its public debut in 1997, shares have appreciated over 1500%. The bank has increased its cash dividend every single year since going public and increased its dividend in 12 of the last 13 quarters. The bank has a net interest margin of 5.51%, one of the highest in the industry due to its high-yielding loan portfolio which includes covered loans (9.01%) and non-covered high equity commercial real estate (CRE). Bank of the Ozarks' typical CRE has 45% cash equity, an enviable position.

Bank of the Ozarks is one of the great growth stories in banking that most investors north of Arkansas have never heard of. It's my opinion that Bank of the Ozarks' stellar performance is nowhere near done. I believe Bank of the Ozarks will likely double over the next two years due to its strong management and ability to do smart acquisitions.

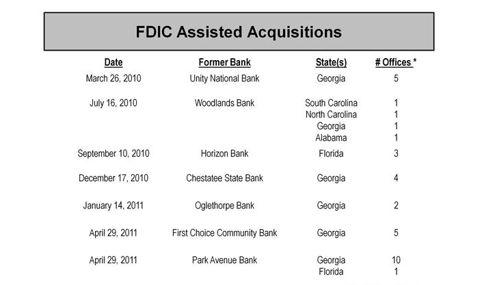

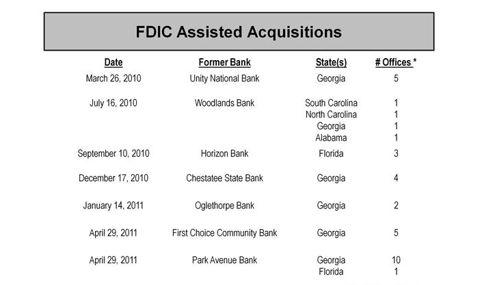

The FDIC-Assisted Transactions

Since January 2010, Bank of the Ozarks has acquired more failed banks (7) than any other institution and, consequently, has an unrivaled experience managing troubled loans. In these acquisitions, Ozarks assumed substantially all the assets and deposits of the failed banks. These deals were structured with a loss share agreement. As such, the FDIC guaranteed that all loans are "covered": Eighty to ninety five percent of any "covered" loan loss is guaranteed by the FDIC. The upside is left intact: Bank of the Ozarks keeps the profits on those loans that produce. That makes these deals extremely lucrative for a wise acquirer. Bank of the Ozarks bid well for these seven acquisitions: The bank was able to book over $100 million of profits by capturing the assets at bargain basement prices. Further, all seven acquisitions have been profitable. In fact, the "covered" loan portfolio has a very attractive 8.78% yield, mouth-watering when you consider that any individual defaulting loans are guaranteed from 80 to 95%.

(Click to enlarge)

(Click to enlarge)

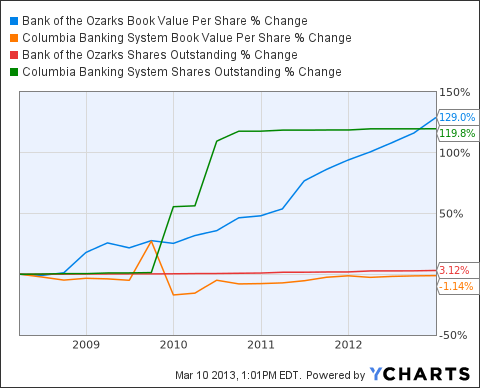

Contrast Bank of the Ozarks' experience to Bank of Columbia (

COLB) which acquired five failed banks during the same time period of 2010 to 2011. Bank of the Columbia doubled its share count to make the acquisitions, book value has remained close to pre-acquisition level and EPS is far off its 2007 numbers.

(Click to enlarge)

(Click to enlarge)

While it is intent on acquiring more failed banks, Bank of the Ozarks has not won a bid for a failed bank since 2011. Fewer banks are failing and the competition to acquire them as grown. As a result, Bank of the Ozarks is expanding its takeover targets.

New Strategy: Another Game Changer

To make use of its strong capitalization and expand its geographic base, Bank of the Ozarks has shifted toward purchasing "live" banks. It acquired Genala Banc, a single branch bank in Alabama last December, and, more importantly, is acquiring The First National Bank of Shelby, a 14 branch bank in North Carolina to complement its presence in nearby Charlotte.

First National Bank of Shelby is being acquired for $67 million and could be another game changer for Bank of the Ozarks. This venerable bank (established in 1874) got caught in the housing collapse. What is appetizing about this "problem" bank is that OZRK is

acquiring $857 million in assets with $474 million of loans and $652 million of deposits, leaving a substantial $200 million cushion to cover delinquent accounts. First National has been working through its problem loans since being

cautioned by the FDIC in June 2011. First National has $55 million

nonaccruing loans, a position that would leave Bank of the Ozarks with a potential bonanza. Most likely, Bank of the Ozarks will book another bargain basement gain on the deal while expanding its geographic footprint. Considering a $67 million price for an ongoing banking enterprise with potentially over $145 million in net equity, the acquisition is mouth-watering. As said, OZRK has considerable expertise at identifying valuable institutions for takeover and has been able to work through problem loans in multiple other acquisitions with a dedicated group of in-house merger division. This one should be highly profitable.

Capacity For More Deals

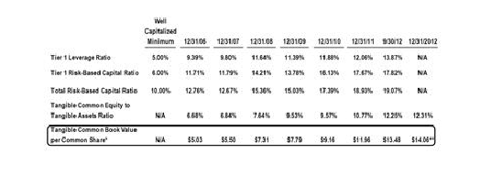

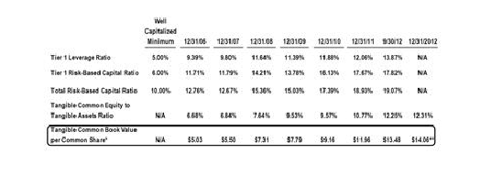

Bank of the Ozarks has a fortress balance sheet with strong capital ratios. Its capital ratios have strengthened over the last 10 years despite acquiring seven failed banks.

(Click to enlarge)

(Click to enlarge)

(Table courtesy of Bank of the Ozarks.)

The bank estimates it has the capacity to do

another $2 billion worth of all-cash deals and still be within their capital regulatory guidelines.

The Huge Short Position

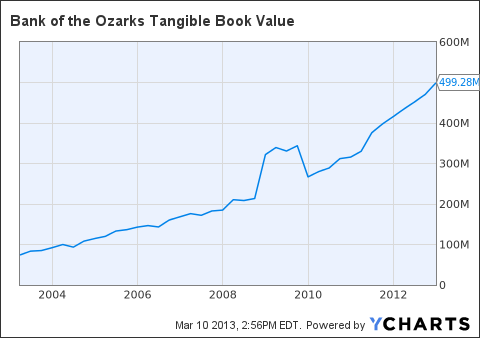

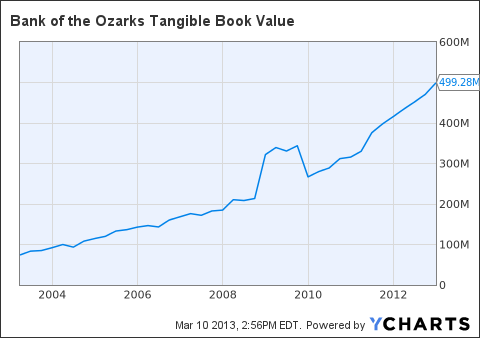

For years, Bank of the Ozarks has attracted a giant short position. The shorts are concerned about Bank of the Ozarks' high 3.0 price to tangible book ratio. However, the bank's assets are high yielding, averaging 6.48%, far exceeding that of the average bank. Moreover, the Bank of the Ozarks has been rapidly increasing its tangible book value through acquisition and loan production. Simply, share price has risen faster than tangible book because the story is that good.

(Click to enlarge)

(Click to enlarge)

Loan Production

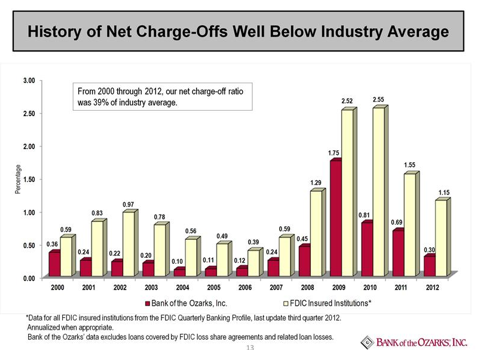

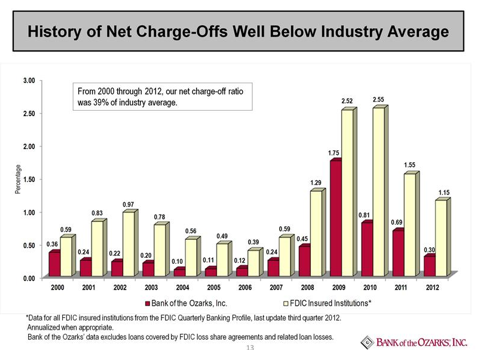

The bank has made good loans: it has a remarkably low charge-off.

(Click to enlarge)

(Click to enlarge)

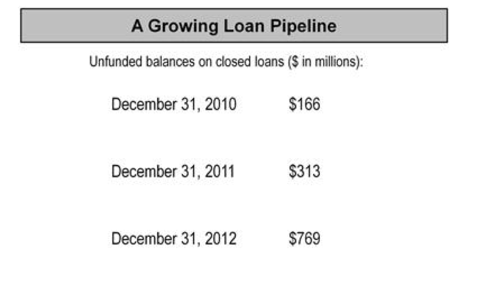

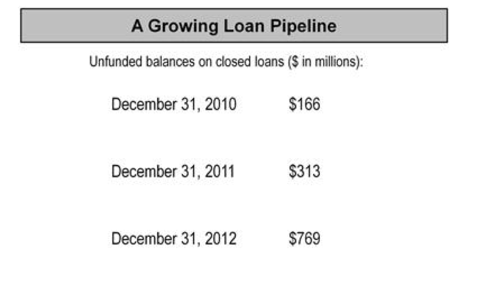

Its goal is to increase loan production from its current $235 million to at least $360 million in 2013 and $480 million in 2014. That's more than do-able: Bank of the Ozarks has a large $769 million unfunded book of

closed loans as noted below. These are loans that are set to go. The loans have closed. Construction companies have to build enough cash equity into their projects before they can draw on their loans. Typically, Bank of the Ozarks has 45% equity in their CREs. Please note: The bank's tangible book value does not include these $769 million of loans.

(Click to enlarge)

(Click to enlarge)

Bank of the Ozarks makes conservative loans while aggressively expanding its geographic base through smart acquisitions. Of note, the stock has split twice since going public. That occurred each time shares reached $44. We are not far from that share price. Another split would likely keep the juices flowing. Bank of the Ozarks is likely to outperform its industry.

Never met the man, but my wife worked with him in the past, and it was her experience that made me buy the shares a few years ago.

Between him and his wife, they own over a million shares - alignment with shareholder interest is a given at that level.