Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

You don't need to know a weatherman to know which way the wind blows...

Just ask Dunkin' Donuts' (

DNKN) CEO Nigel Travis.

Listen to his comments on Friday's J.P. Morgan Forum (and by the way, he plugs SeekingAlpha.com's thoughts about weather and restaurant sales):

But I think I would say that this is probably -- we haven't had the huge depths of snow that we had 2 years ago in the Northeast, but we've had more regular storms. It seems that we've have a storm every week. So I'd say it's probably similar to 2011 and I've never worked it out but I'd say that 150 basis points probably goes back the other way.

For those of you not living in the Northeast - the home of so many Dunkin' Donuts - Winter 2013 has been a horrible unending series of snowstorms. I've been hitched up to my snow blower. In contrast, the comparable 2012 quarter was one of the mildest winters on record, making for some difficult comparisons.

We are going against the quarter last year, where we had exceptionally good weather for our business. So we always said this quarter was going to be a challenge.

Indeed. Not too many New Englanders got their coffee and donuts in 2-foot blizzards.

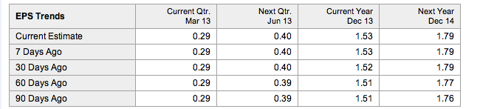

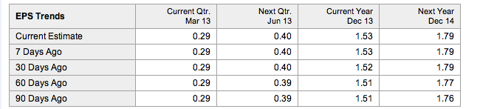

Perhaps, the analysts following Dunkin' Donuts live in sunnier climes. You'd think that after looking at their rosy EPS and revenue forecasts. Consensus expects an optimistic EPS of 29 cents versus 25 cents in the year-ago quarter. Revenue is forecast at $161.78 million, 6% higher than a year ago. Notice estimates haven't budged over the last 90 days despite the miserable winter. Those analysts must really be enjoying that Florida sunshine!

(click to enlarge)

This winter's dismal weather report might be a better forecaster of Dunkin' Donuts' quarter than a roomful of analysts. Before you push the DD eject button, remember that awful New England winters don't come every year. In fact, the weather's become lovely...

I'd take the recent pull-back in Dunkin' as an opportunity to get in the stock before the snow melts.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Otherwise, the fairly strong same store sales numbers that a weaker competitor, Krispy Kreme (KKD) and the positive US same store sales results released by Starbucks (SBUX) and Tim Horton's (THI) does seem, to support the case that lower average ticket 'beverage' concepts seem to be "hot", if there is average ticket upside via food attachment and new product new news.

John A. Gordon

Pacific Management Consulting Group

chain restaurant analysis and advisory

http://bit.ly/m8ad9

Yes - it is called half of the country, west of Mississippi. The only trully saturated market is Northeast, where they started. Southeast still has some room, but it is probably less robust, however DD has no real presence in western US, including California. There is no reason for them not to achieve similar presence in CA similar to that they have currently in FL, which means there is tons of growth potential. The only limits are execution and fund availability.

Single digits growth is for same store sales, earnings and overal sales growth will go through leaps and bounds, as expansion continues. Perhaps not every single quarter and there surely will be some sputters, but Dunkin is essentially "regional-to-national" story to be played out in next 10 years.

Doesn't mean of course one has to buy their stock today... There may be a better price coming, but the story is definitely very compelling to me.

2010 sales $577m

2011 sales $627m 8% growth

2012 sales $657m 4% growth

What is clear is the 2% earnings yield, what is not clear is the future.

Wasn't DNKN a PE holding being consolidated in 2010 and most of 2011?

over the new S&P 500 record high. Deja 2007 all over again.

$4 breakfast is likely one of the last things to be be cut from discretionary spending.

I was trying to have a reasonable conversation, but this comment (and comparing now to 2007) exposed you. There is really not nothing more to say. Enjoy your short positions.

It may take as long as 6 months or even 2 years for Dnkn to get whacked, but it most likely will.