Seeking Alpha

Hello,

I’ve been correctly calling individual stock moves for the last 5 years. I’d like to offer my research to you.

My stock picks have outperformed the market handily. The nice part: You can verify my claim – I blog at SeekingAlpha.com. You can read my articles and note some very timely calls.

For instance, I have been long Apple since 2007 and short Nokia, RIM, and Hewlett-Packard. During a 5-year period, I published over 50 articles explaining why Apple should be bought and its competitors sold. Following my advice would have a portfolio manager’s career as Apple soared and Nokia, RIM, H-P crashed.

I correctly predicted Pilgrim’s Pride’s bankruptcy. Making a bet against that company would have made the portfolio boatloads of cash.

I suggested dumping Bank of America and, instead, buying a small regional bank. Bank of America cratered; the regional soared.

I suggested buying a basket of SaaS stocks in 2011 – all either doubled or were taken out a year later.

More recently, in January, I predicted 7 stocks – Limited Brands, Wynn Resorts, The Buckle, Werner Enterprises, Stamps.com, Armstrong Worldwide, and MTOX Scientific – would announce large special dividends before year’s end. To date, Limited, Wynn, The Buckle, Werner, and Armstrong have all declared special dividends. MTOX didn’t get a chance – it got acquired, giving shareholders a 94% YTD return.

I’d like to offer you or your firm research to help you pick next year’s winners.

I am a retired physician who has been analyzing stocks for 15 years. I publish my market research on SeekingAlpha.com, where I am followed by a number of money managers and analysts. I use a combination of technical and fundamental analysis as well as proprietary metrics. My picks – both long and short – have been very successful. I’d be glad to give you the links to my articles so you can substantiate my claims.

I am eager to share my advice and research on an exclusive basis.

If you’re interested, you can reach me at stephenjrosenman@gmail.com.

Best,

Stephen J. Rosenman

seekingalpha.com/author/stephen-rosenman

| ETFs | TODAY | 3 MTHS | 1 YR | YTD |

|---|---|---|---|---|

| RWL | 0.6% | 12.2% | 17.1% | 13.0% |

| EPS | 0.5% | 9.7% | 10.3% | 10.0% |

| PRF | 0.1% | 11.8% | 15.7% | 11.7% |

| SDY | 0.1% | 12.2% | 16.3% | 12.3% |

| SSO | 0% | 19.5% | 25.5% | 19.5% |

| SPY | 0% | 9.3% | 11.4% | 9.2% |

| DIA | -0.2% | 10.4% | 10.7% | 10.7% |

| XLI | -0.3% | 9.7% | 11.7% | 9.5% |

| BA | -0.4% | 13.9% | 15.4% | 13.9% |

| IPN | -0.9% | 6.4% | 8.2% | 5.9% |

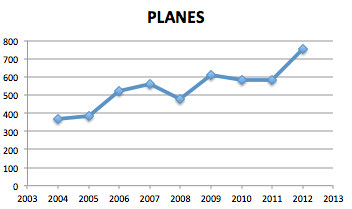

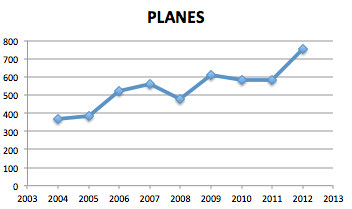

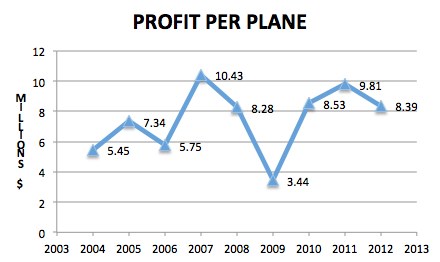

Let’s put some of these numbers in context. Boeing has 800+ orders for the 787, which has been on sale for about a decade now. That’s considered to be great, for a twin isle plane. Last year, 2012, Boeing had 1124 net orders for the 737 (-11 net for the 787, by the way). 415 of the 601 commercial aircraft delivered last year were 737s.

Boeing and Airbus orders are often conflated with sales but orders are not at all what layman would think of as sales. EADS/Airbus has succeeded in getting the business press to hype the yearly order totals while at the same time diluting their “worth” by stretching the orders far out into the future and also counting many orders that never materialize (normal, but not to the extent Airbus has taken it to). This allowed Airbus to project the perception that they were much larger than they were, many years ago, and also to make them look much more successful than Boeing. Both those misperceptions are easily shown to be false by simply looking at the financial numbers for the companies. Airbus won the yearly orders race for 10 straight years and yet, in 2012, Boeing delivered more planes than Airbus – doesn’t quite add up, does it?!

Don’t get me wrong, Airbus is a great company and has had amazing success in a very complex business, in a short span of time. But Boeing has done quite well themselves and, I believe, the 787 will be a huge success for many years to come.

Thanks for the information.

The article discusses deliveries, not orders.

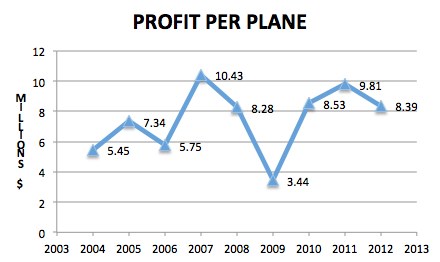

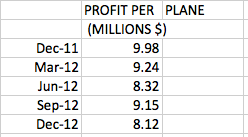

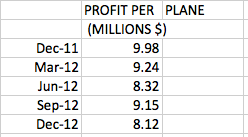

You'll note that, in Dec 2012 quarter, Boeing delivered 23 787s and 105 737s while in Dec 2011 quarter, Boeing delivered 2 787s and 91 737s.

Yet, despite delivering a much greater number of the more expensive 787s, average aircraft profits dropped by $1.86 million a plane.

While there are lots of moving parts (plane mix, timing of payments), the unit profit trend is not good.

http://bit.ly/VcuSMc