Seeking Alpha

Too Late To Sell? Look Who's Trying To Dump J.C. Penney

Hello,

I’ve been correctly calling individual stock moves for the last 5 years. I’d like to offer my research to you.

My stock picks have outperformed the market handily. The nice part: You can verify my claim – I blog at SeekingAlpha.com. You can read my articles and note some very timely calls.

For instance, I have been long Apple since 2007 and short Nokia, RIM, and Hewlett-Packard. During a 5-year period, I published over 50 articles explaining why Apple should be bought and its competitors sold. Following my advice would have a portfolio manager’s career as Apple soared and Nokia, RIM, H-P crashed.

I correctly predicted Pilgrim’s Pride’s bankruptcy. Making a bet against that company would have made the portfolio boatloads of cash.

I suggested dumping Bank of America and, instead, buying a small regional bank. Bank of America cratered; the regional soared.

I suggested buying a basket of SaaS stocks in 2011 – all either doubled or were taken out a year later.

More recently, in January, I predicted 7 stocks – Limited Brands, Wynn Resorts, The Buckle, Werner Enterprises, Stamps.com, Armstrong Worldwide, and MTOX Scientific – would announce large special dividends before year’s end. To date, Limited, Wynn, The Buckle, Werner, and Armstrong have all declared special dividends. MTOX didn’t get a chance – it got acquired, giving shareholders a 94% YTD return.

I’d like to offer you or your firm research to help you pick next year’s winners.

I am a retired physician who has been analyzing stocks for 15 years. I publish my market research on SeekingAlpha.com, where I am followed by a number of money managers and analysts. I use a combination of technical and fundamental analysis as well as proprietary metrics. My picks – both long and short – have been very successful. I’d be glad to give you the links to my articles so you can substantiate my claims.

I am eager to share my advice and research on an exclusive basis.

If you’re interested, you can reach me at stephenjrosenman@gmail.com.

Best,

Stephen J. Rosenman

seekingalpha.com/author/stephen-rosenman

| ETFs | TODAY | 3 MTHS | 1 YR | YTD |

|---|---|---|---|---|

| JCP | 1.5% | -23.3% | -57.4% | -23.3% |

| RWL | 0.6% | 12.2% | 17.1% | 13.0% |

| EPS | 0.5% | 9.7% | 10.3% | 10.0% |

| XRT | 0.4% | 13.5% | 14.5% | 13.1% |

| IPD | 0.2% | 7.8% | 11.4% | 6.5% |

| PRF | 0.1% | 11.8% | 15.7% | 11.7% |

| XLY | 0.1% | 11.3% | 17.9% | 11.0% |

| SDY | 0.1% | 12.2% | 16.3% | 12.3% |

| SSO | 0% | 19.5% | 25.5% | 19.5% |

| SPY | 0% | 9.3% | 11.4% | 9.2% |

I still think JCP will pull through.

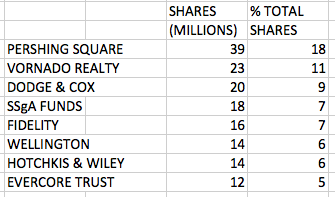

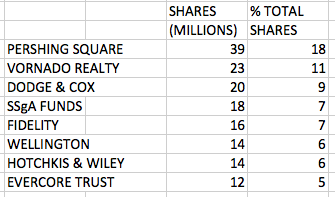

1) The largest holder, Pershing Square, purposely bought a large stake *because* of the poor performance, *before* your "bearish call back in March 2012."

2) He did this to force on a new CEO to do massive cost cutting and turn around the company

3) The CEO has been incentivized for 3 years (it's only been a bit over a year?) in regard to stocks.

4) Based on the time needed for a turn around, and because of how the CEO has been incentivized, Pershing Square said they are waiting 3 years for a turn around.

In contrast, had they sold on my sell recommendation last March, they would have saved themselves over $800 million or 60% of their holding.

Why they decided to totally revamp the company is beyond me. Better inventory management, incentivizing staff, improving store appearance, closing underperforming stores and maybe trying out Johnson's ideas in a few model stores...that was the way to go.

JCP only needs to attract back these shoppers with some good promotions. Then they'll see the changes and appreciate the leadership of the CEO. Very tasteful and forward looking.

9