Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

How can you predict which brick-and-mortar retailers are worth investing in and which should be avoided? It's a tough group. They not only have formidable store-front rivals but face strong on-line competition as well. Yet, some brick-and-mortars have thrived: Home Depot (

HD) is up 47% while Walmart (

WMT), and Costco (

COST) have climbed over 12%, 17% and 20% respectively in a year. In contrast, two others - Sears (

SHLD) and J.C. Penney (

JCP) - have been miserable for shareholders.

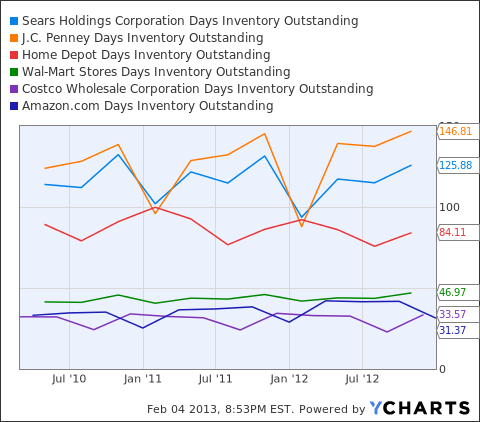

I've used the metric "Days In Inventory" to successfully predict a retailer's future share price. In fact, I correctly

forecast the fate of these five retailers' share prices a year later. Five out of five isn't bad. That's testament to the power of this metric.

To refresh: Days In Inventory measures the length of time it takes a company to move its goods.

Days In Inventory = Inventory/Cost of goods x 365 days

The thesis: In retail, it's the kiss of death to have inventory linger on the floors. The longer a company holds its inventory, the longer its cash is tied up. Worse, retailers are often forced to mark down their goods to unload excessive inventory. When you are competing against a strong on-line retailer like Amazon (

AMZN), high Days In Inventory is a recipe for disaster.

But really, does it work?

In the words of the late great Louis Rukeyser: "You betcha!"

Last year, I predicted that Sears and J.C. Penney would get slaughtered while Costco, Walmart, and Home Depot would thrive. Why? Because Sears and J.C. Penney had much higher Days of Inventory than Costco, Walmart and Home Depot.

Per that article:

Make no mistake: Sears and J.C. Penney act more like museums than retailers. They've become simply corridors to get to the rest of the mall. The tip off: The two can't unload their inventory. Goods move at a trickling pace and it's killing the bottom line.

Indeed, Sears and J.C. Penney have embarrassingly high Days of Inventory - red flags that should send investors running to the exits. Neither company has been able to improve its inventory management.

The graph below contrasts how each of these 5 retailers have done since my article. My prediction using Days In Inventory to forecast share price proved spot-on. Since the article, Sears and J.C. Penney cratered 36% and 47% respectively while Home Depot, Walmart, and Costco performed well.

Uncannily accurate or just dumb luck? I'll let you be the judge. My suggestion: Days In Inventory should be assessed before purchasing any brick-and-mortar retailer.

Until Sears and J.C. Penney find a way to markedly improve their inventory management, avoid them. These two retailers have really become corridors to get to the rest of the mall.

Additional disclosure: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

They are focusing online instead of brick and mortar and many of their properties will be used as distribution warehouses with only profitable anchors staying open.

Google - Bruce Berkowitz Case Study 111 - Sears Holdings

You will then understand what Sears HOLDINGS is about.

He has left his CEO position at ESL to be CEO of Sears Holdings.

Merger iminent.

Lahiem

I haven't heard Lampert or Sears Holdings announce that their stores will turn into "distribution warehouses with only profitable anchors staying open" .....unless you're now in charge of public relations for Sears?

Know what you are talking about.

Lampert always was in control - this move in the position now is for the merger.

http://seekingalpha.co...

The others will lease their warehouse space through Sears' properties, hense , Sears Holdings Corporation Realty and Management.

Some properties are better sold, leased or converted to a warehouse.

SHC Realty and Lampert know what to do.

Put it another way, if you compare the same metrics between SWY and HD, I'm pretty sure SWY is going to significantly outperform HD as the goods that SWY carries spoils with time - not so much with the goods carried by HD. By the way, a descent amount of sales from WMT and COST comes from grocery.

Similar criticisms to yours were made when I published my predictions a year ago.

However, using DII, I was able to predict the stock movements of 5 stocks a year out.